Find World-Class Stocks in Just 2 Hours a Month — With Research That’s Beaten the S&P 500

Don’t Have Time to Research Stocks? We’ve Got You Covered!

If you want to see your portfolio be filled to the brim with companies that continue to give you returns for years or decades to come.

Avoid another year of investing in companies that only turn your portfolio red and make your hard-earn money go up in smokes.

To cater to those visual, auditory and kinesthetic learners..

Live Webinar In-depth company analysis presentations: Have all the details you need about a company and its industry presented to you live every month so you make an investing decision within 2 – 3 hours.

Deep Dive Report One-Pagers: No time for a 1 hour video? No problem! The one-pager reports contain key financial ratios, competitors’ data & valuation range – all on one page – will only take you 3 minutes (tops!).

Rapid decision-making: Say goodbye to long hours of trawling forums, asking friends and scratching your head to find high-quality companies – get up and running within the first hour.

I am the founder of VUCA Insights, where I help clients with private mandates for their equities accounts.

I caught the investing bug 16 years ago when just started out in my career with the second largest energy company in the world, Royal Dutch Shell.

For the last 16 years, I’ve been investing my portfolio and my family’s money for the past 10 years using timeless value investing principles I’ve refined throughout the years.

These principles have helped me generate a CAGR (Compounding Annual Growth Rate) of more than 12% over the last 10 years, outperforming the S&P 500.

Today, I want to show you how you can access the exact framework I use to shortcut your time in selecting great companies to invest in.

Today, I want to show you how you can access the exact framework I use to shortcut your time in selecting great companies to invest in.

You’ve known for years now that you should be a better investor.

But no matter how hard you try, you can’t seem to get out of an investing rut.

You’ve voraciously read hundreds or thousands of threads on investing forums, followed investing news and even gotten stock tips from investing gurus.

Yet, nothing has stuck.

Most of the companies you invested in turned out to be flops, shrinking your retirement pot. Some seemed to have a lot of potential at first, only to fizzle out after some time.

You came into investing thinking it was the best way to grow your wealth. Now, you’re wondering if you’re making a mistake.

Frankly speaking, you’re exhausted and inside, you’re starting to panic a little.

What if you never become a good enough investor?

If any of the above sounds familiar to you, don’t worry. You are not alone.

Many investors are in the same position as you.

You see, to know if a company is worth investing in, you need to understand it in and out. And not just that, you need to understand its industry through and through.

Practically speaking, this will take you at least 40 hours of research for one company. And more if you don’t have a good grasp of the industry the company is in yet.

Oh yes you didn’t read that wrong. I did say 40 hours.

That’s a whole week of full-time work.

Case in point:

If the company you’re analysing the investing potential of is an Automated Test Equipment (ATE) Manufacturer in the semiconductor industry, you need to have read and understood the value chain of at least 60% of the industry to be able to grasp how well this ATE is doing or will be doing in the future.

And boy, is that industry domain knowledge hard to come by.

Even as an engineer trained in electronics, it still took me 7 years to understand the industry. Imagine how much more time it would take those without a technical background or industry exposure.

Don’t get me wrong. I’m not trying to pour cold water on your effort to do it.

It’s just a lot of work, which translates to a lot of time.

Time that most people don’t have.

The sheer amount of work is intimidating enough to put a lot of people from even starting the process or worst, risk losing their money by investing in a company with incomplete information.

What if it could all be done for you?

Imagine this:

Instead of having to carve out 3 – 4 hours every day to research, saying no to social outings, going around hitting walls and making mistakes, becoming more and more exhausted..

… and still not find enough time to do complete research.

… and still seeing your portfolio dwindle down in size, breaking your heart.

You simply attend a live session or watch the recording of the session every month and be brought up to speed on everything you need to know about the investment potential of a carefully selected company laid out for you.

Your time investment per month - 90 mins + 90 mins.

And they’re not just any boring one-pager analyst report you could find in generic newsletters.

Every little thing you need to know is included:

A presentation that would take anywhere between 80 and 100 hours to prepare condensed into something that will take less than 2 hours to consume.

All you have to do now is decide if or when you want to add a company to your own portfolio.

These reports even include insights from materials that are hidden from 99% of retail investors; research materials that include reports worth thousands of dollars a pop, most of which are not even for sale.

What a relief.

Now, you can sleep easy while knowing that while you continue living the life you want, a professional investor is helping you do all the research work in the background.

Credit: BT

Few people can claim to have turned a modest investment of $8.3m into $732bn.

But that’s exactly what Warren Buffet did.

When Buffet took over Berkshire Hathaway in 1965, it was just a small textile company about to go bankrupt.

Its price? Just $8.3million (or $19/share).

Almost 60 years later, Berkshire Hathaway is now worth a whopping $732billion.

That’s a return of over 10 million times.

10 million!

Warren Buffet’s investing prowess is so impressive that many have wondered what his secret was.

In fact, in late 2001, when Buffet was giving a talk at Columbia University’s business school, a student asked Buffet exactly this question: What was his secret to getting such high returns?

To answer this question, Buffet pulled out a huge stack of papers and told the audience that he read 500 pages a week.

He further went on to say that anyone could do it, and if anyone did, their knowledge would compound over time.

A student in the audience would take this advice seriously and dedicate himself to reading 500 pages a week.

This student later became one of Buffet’s highest-performing investment managers at Berkshire, so successful that he is frequently cited as a potential successor to Warren Buffet as Chief Investment Officer at Berkshire.

The student’s name? Todd Combs, the CEO of GEICO today. Credit: Bloomberg

Credit: Bloomberg

There’s no doubt about it:

If you want to become a good investor, you need to be good at the boring skill of reading.

It’s this boring skill that allows Buffet to gain insight into companies and industries before making decisions that move millions of dollars.

“But I don’t have time to read 500 pages a week!”

Warren Buffet and Todd Combs can read 500 pages a week because it’s their job to go really deep into companies.

It’s their primary responsibility to shareholders who invest money with them to make good judgement calls.

But most people aren’t fund managers.

You’re just regular people with day jobs.

You can’t dedicate 5 – 6 hours a day to reading. You barely have enough time for family, friends, hobbies and a vacation every other month.

Maybe you can only dedicate 1 – 2 hours a week to do research.

But with such limited time, you could end up investing in lousy companies because of hype or worse, pay for programs that teach you to invest in financial products you don’t even understand.

These are the quickest ways to lose a lot of money 💸

If you continue doing this over long periods of time, you could even end up losing your entire life savings.

The good news is, even if you can’t read 500 pages a week, you now have access the next best thing: StockWyse.

With the click of a button, you’ll have access to a library of in-depth analyses of companies worth investing in.

The Hardest Index to Beat in the World

The S&P 500 tracks the performance of the top 500 companies in the US by market capitalisation.

That is why it is often used as a benchmark for investor performance.

Since it tracks the top 500 companies, the S&P 500 is expectedly, pretty hard to beat.

In fact, a report in 2022 found that 80% of active fund managers fail to beat major indexes like the S&P 500.

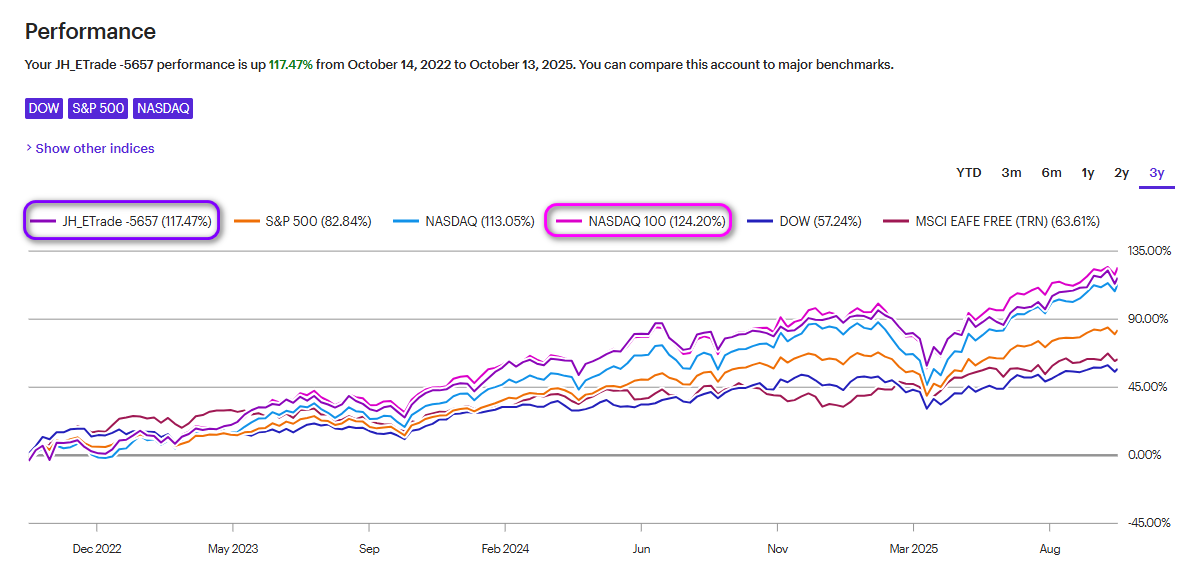

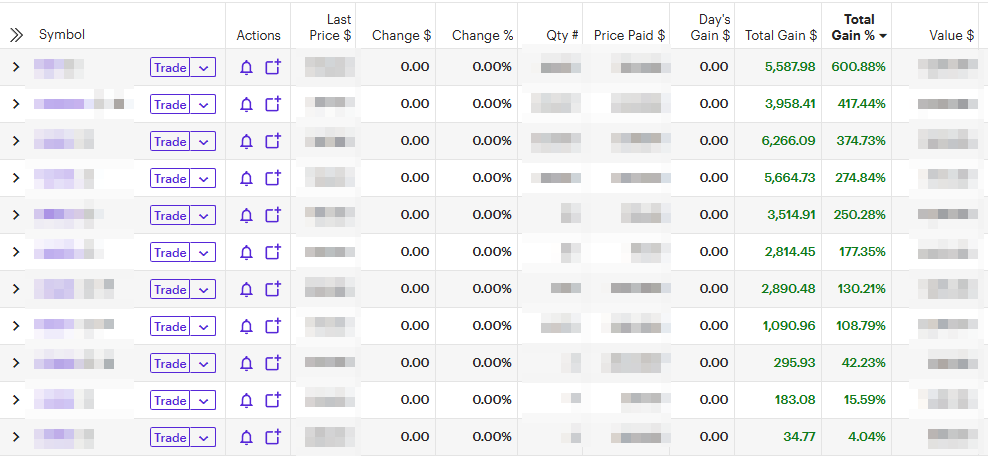

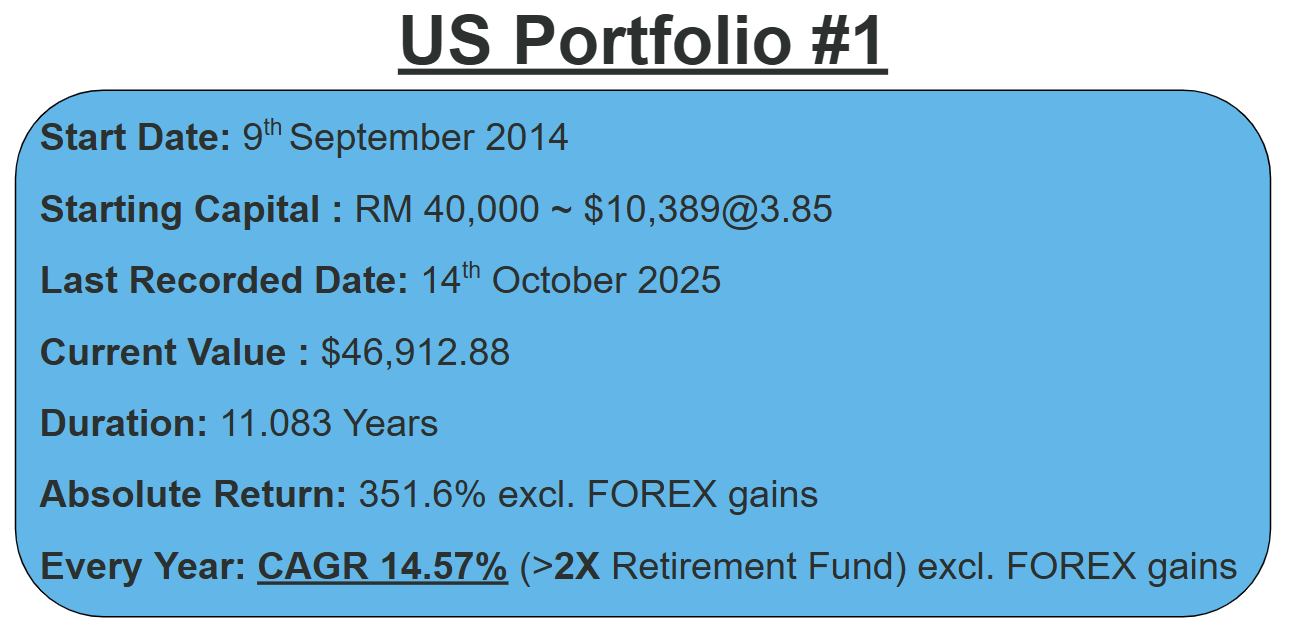

My investing framework – refined over 16 years – has enabled me to beat the S&P 500 for not only 1 or 2 years, but 11 years.

I’m not just going to tell you about it.

I’m going to show you my results.

Here’s a snapshot for the last 3 years (Oct 2022 – Oct 2025):

And here’s the full history of my returns in the last 11 years (since 9th September 2014):

The CAGR rate is now 14.57%. Hang on, didn't the market just crash due to the Trump tariff wars? This is Oct 2025 we are talking about right?

Yes, because I know the market moves in cycles, and right now with the US in a bearish state and for most who have just witnessed their first major market crash since COVID-19 of 2020, they are mainly in a state of panic. So my portfolio is real proof that make time your friend, instead of your foe. I've kept my head down, do the work which is the research to understand companies better, buy them at a reasonable price, and patiently ride their tails...

Here’s the best part, you get to “tag” along for the ride should you wish to. So when you join StockWyse, you can be sure of one thing:

You get insights and best practices from a real-world practitioner.. not an academic preacher who likely shares concepts... but no skin in the game...

And these insights are not only in-depth and concise but also highly actionable.

Who am I helping?

With a good track record of performance, I started to get requests from people who knew or heard of me to help them with their equity accounts.

Since investing is my passion, I decided to start helping clients with private mandates for their equities accounts more than a year ago.

In this arrangement, the client’s equity account is individually managed on their behalf with them owning the equity/shares instead of the fund management company.

As you can imagine, I was approached by clients with various account sizes.

Alas, I couldn’t accept them all.

Many of them had account sizes that were below my minimum (6-figure range).

But I always wondered how I could still serve them somehow. When I first starting out investing, I didn't have a 6-figure portfolio to my name either. Who helped me back then? That thought gnawed at me relentlessly.

After some brainstorming, I realised the solution was starring me straight in the face:

Why don’t I just open up access to my research? This way, even if I can’t help them with their accounts, they’ll be able to use the same research materials to do it themselves.

All I have to do is charge a nominal fee for access to the research. This also helps defray the cost of hosting the materials on the web (mind you it's not cheap!).

And that is how StockWyse was born 🥳

It is the next best thing to have me help you with your private mandate for your equity account.

The frameworks for identifying great companies, which have been refined over 16 years, are all available to you once you become a member of StockWyse.

Stock idea newsletters are a dime-a-dozen. If you’ve bought using the advice given by these newsletters, you’ll quickly find one big problem:

They don’t always work.

And the biggest reason they don’t is because the people writing them are analysts who most likely don’t have any of their money invested in the companies they’re sharing with you about.

StockWyse is different. They include only stocks that I’ve analysed thoroughly and SOME WITH MY OWN MONEY INVESTED IN, SOME ARE KIV due to high valuation at the point in time.

And this – my skin in the game – is what makes this subscription different from the newsletters you see elsewhere.

By becoming a premium member of StockWyse, you’ll get…....

2 x Monthly in-depth live webinar presentation

2 x Monthly accompanying PDF with company key metrics

Access to the entire library of recorded webinars if you missed any live sessions

Live Portfolio tracker

Facebook private community

Essentially, everything you need to make a confident decision about investing in a company.

As the first subscribers of StockWyse, I’ve included a special bonus just for you.

On top of the 24 premium webinars deep dive you are going to get for the next 12 months, you’ll also be getting…

.

.

.

30+ EXTRA Deep-dive Reports (Worth US$1999)

So instead of getting 24 webinars in your first year, you’ll be getting the extra >24 deep dives we have already covered in the past years.

The combined value of the extra these archive is US$1999 – all yours for FREE when you subscribe today.

These are available to you immediately upon confirming your subscription. You will have >20 stock ideas you can dig in within minutes of gaining access.

The Bonuses Don't End Here...

On top of getting an extra deep-dive reports, I’ll sweeten this deal even more by throwing in one more bonus…

.

.

.

1 EXTRA Industry Report (Worth US$199)

That’s right.

And this isn’t just any report.

I cover one of the fastest-moving trends at the centre of some of the most explosive stock price movements we’ve seen in the last couple of months.

The one technology that’s responsible for some of the craziest stock movements we’ve seen in recent years. Like this one ↓

This one report could change the trajectory of your portfolio. And it’s all yours the minute you become a premium member of StockWyse.

.

.

.

With bonuses worth $2198… you must be thinking…

“John must charge a lot for this subscription if the bonus is already worth this much.”

But I’m not going to charge you $10,000/year.

Not even $2,000/year.

.

.

.

Today, you’ll get everything inside StockWyse Premium…

… for just $999 a year.

The StockWyse Annual Subscription will give you:

The difference between time and money is that if we have time, we can always make money back.

But time is the one resource that when it’s gone, it’s gone for good. You can’t make back time.

And this is why I’ve kept the fluff out of every single report.

There’s not a single word wasted in these reports because I think time is the most precious resource you can ever have. And if I can save you a minute, I will.

When you subscribe to StockWyse, you get the results of investment with a minimum of time investment.

I make it a point to keep growing as an investor. And that it why I make conscious decisions to mingle with the very best in the industry. Even if it cost me a bomb to do it.

Take last year when I flew all the way to Omaha to attend the Berkshire Hathaway AGM. The whole trip cost me 5-figures.

And it was worth every penny.

Sure, you could stream the whole shareholder meeting online, but if I did that, I would have missed out on meeting legends like…

Mario Gabelli of Gabelli Asset Management

The legend himself, Mario Joseph Gabelli is the founder, chairman, and CEO of Gabelli Asset Management Company Investors (Gamco Investors), an investment firm headquartered in Greenwich, Connecticut. Forbes Magazine listed him as #1725 in December 2023 on the list of Billionaires, with a net worth of $1.7 billion US dollars.

Chuck Akre

Chuck Akre

Akre established Akre Capital Management in 1989 and used the investment philosophy called the “three-legged stool” which is the business models, rates of return and reinvestment opportunities. He was heavily influenced by Thomas Phelps book “100 to 1 in the Stock Market” and is said to have invested in Berkshire Hathaway since 1977.

Robert Hagstrom

Robert Hagstrom

Author of many books about investing, including the New York Times seller, “The Warren Buffett Way”, Robert Hagstrom is also Chief Investment Officer at EquityCompass Investment Management LLC, and Senior Portfolio Manager of the Global Leaders Portfolio. Monish Pabrai

Monish Pabrai

Currently managing partner of the Pabrai Investment Funds (a family of hedge funds inspired by Buffett Partnerships), which he founded in 1999, he has a net worth of almost 1.8 bil USD as of Aug 2023.

If it’s not already obvious, I’m never satisfied sitting still in my office looking at reports. I go down to the field and talk to the experts who move the market.

And this is something I intend to continue doing for as long as I live.

What this means is that when you subscribe to StockWyse, you’re subscribing not just to reports, but a living, breathing real-life investor’s brain pickings.

Finding good stock ideas can be tough when you’re doing it alone.

I know because I was in this same situation when I first started investing in my 20s as an engineer.

I was bumping my head around, trying to find answers to even the most basic investing questions, only to end up even more confused.

The process is long and tedious without any real ways of moving forward.

Investing forums tell you to invest in Company A. Then you open the news and see that Company B is doing well. A few days later, your friend tells you, they just invested in Company C.

This will only leave you more confused than ever.

Luckily, by subscribing to StockWyse, you can clear the confusion and see all the facts in front of you so you can make an educated decision on whether you should invest in a company.

When I first started investing, it was the 2000s and we still connected to the internet using a dial-up and 1GB of storage cost a bomb.

When I first started investing, it was the 2000s and we still connected to the internet using a dial-up and 1GB of storage cost a bomb.

The only way to get a subscription like this going back then was if I recorded it into a DVD and mailed it to you.

Now, most households connect to the internet using 100Mbps internet. 1GB of storage these days are almost worthless.

And it is precisely for this advancement that I’m able to share my stock ideas with you in such a timely and comprehensive manner. Without charging an arm and a leg.

The beginner investor me would have killed to find an opportunity like this.

Now, the only thing you need to decide is if you want to take advantage of the opportunity we have right now.

The stock that could change your portfolio forever could just be a few minutes away.

You get 2 stock research webinars every month, or 24 stock ideas a year. And you have written and video forms, where in the webinar I can explain it to you rather than you reading a report on your own.

I do all the “hard work” for you, researching the industry trends, joining their earnings call, reading up their quarterly reports and deciphering their corporate exercises and what it means for the investor. My money is in it too sometimes, so I have skin in the game.

If you come across an interesting company that I haven’t covered, by all means, propose it and if it fits the bill I’ll cover it. Think of it as RaaS – Research as a Service. Who knows, what you suggest might be a gem to all of us, especially if it’s in your circle of competence but rocket science to the rest of us.

You also have a private Facebook group that leverages the strength of the community of investors, not just me to bring you better insights into investing. Post your questions there, and I’ll get back to you within 3 working days.

Best of all, you have a Live Portfolio Tracker of all the stocks I’ve covered. Well almost live as Google only updates their stock prices every 15 minutes. Good enough for me!

So, what are you waiting for?

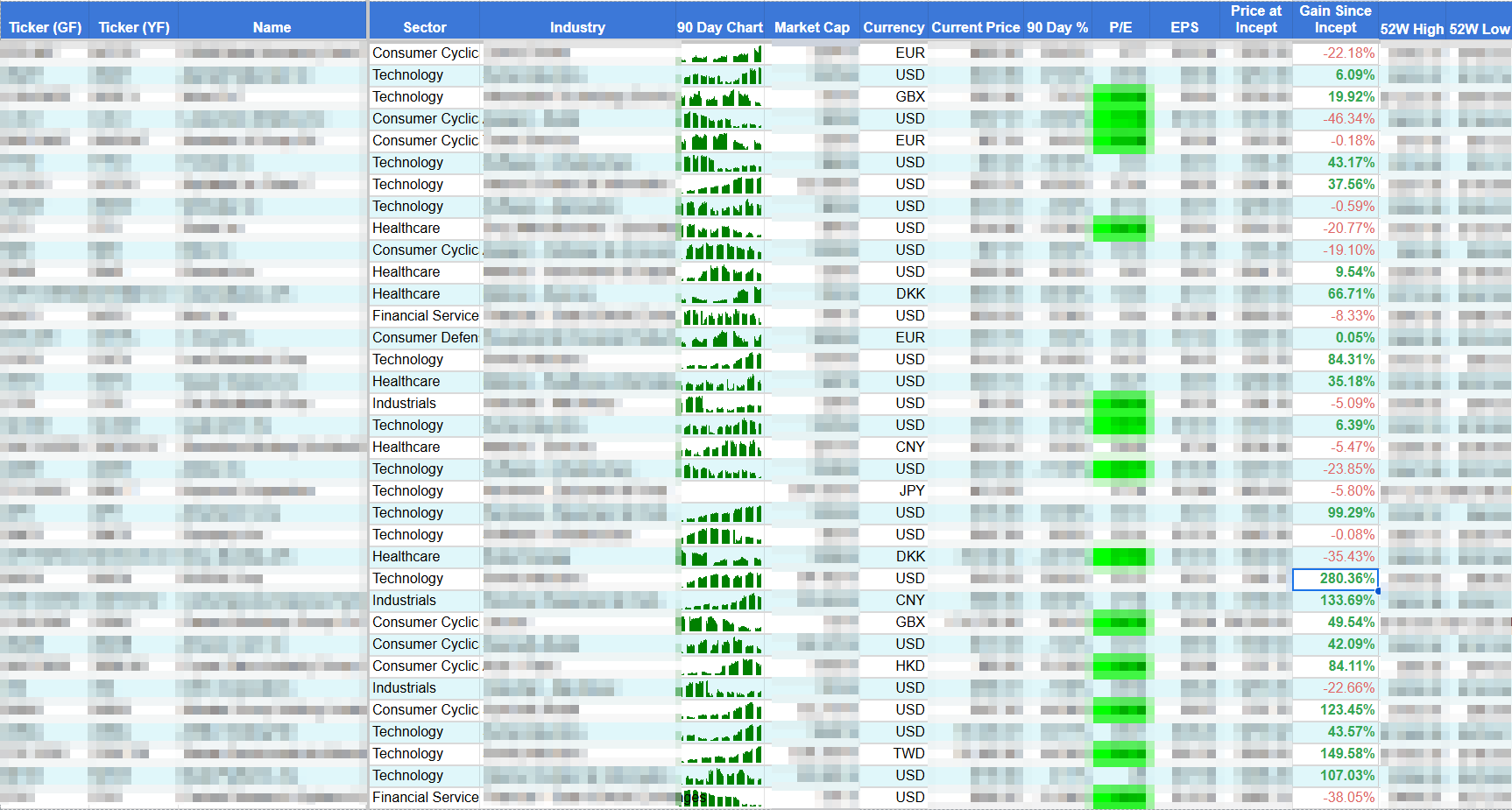

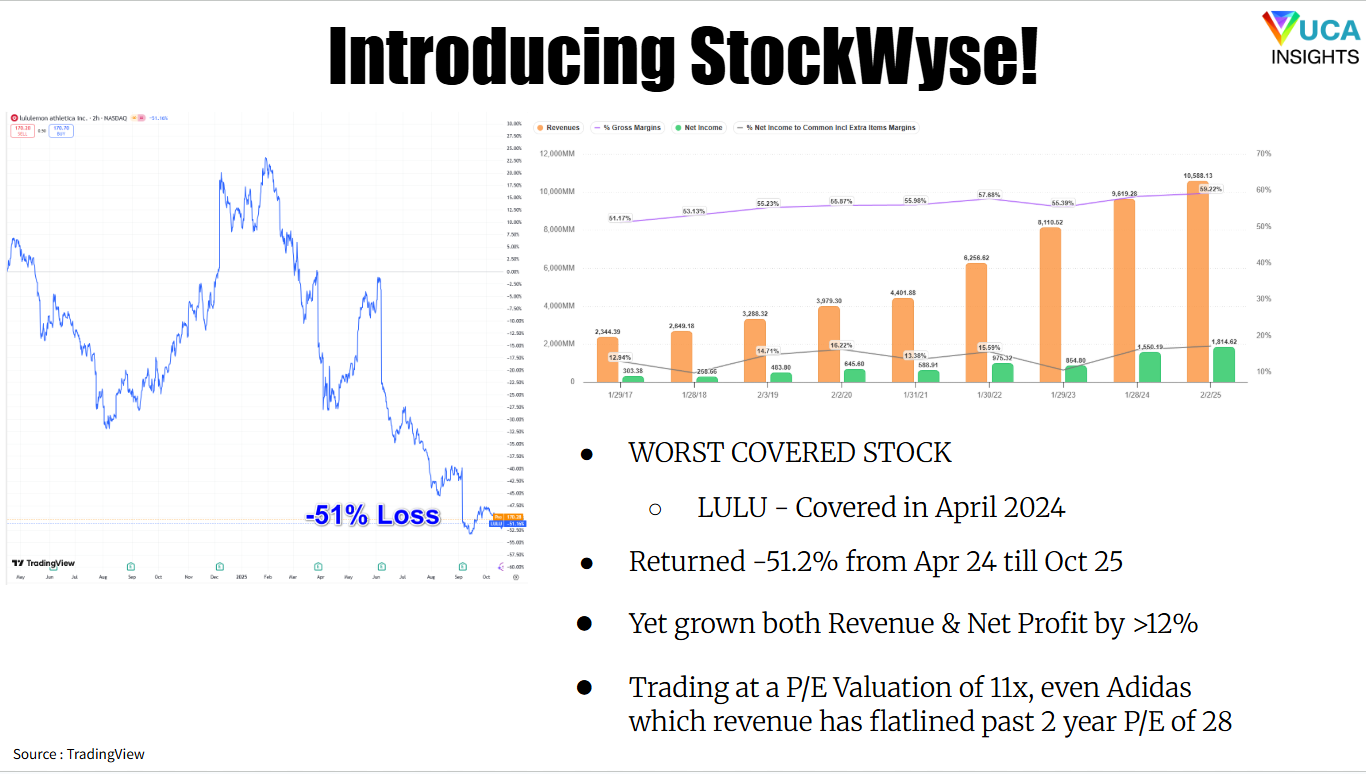

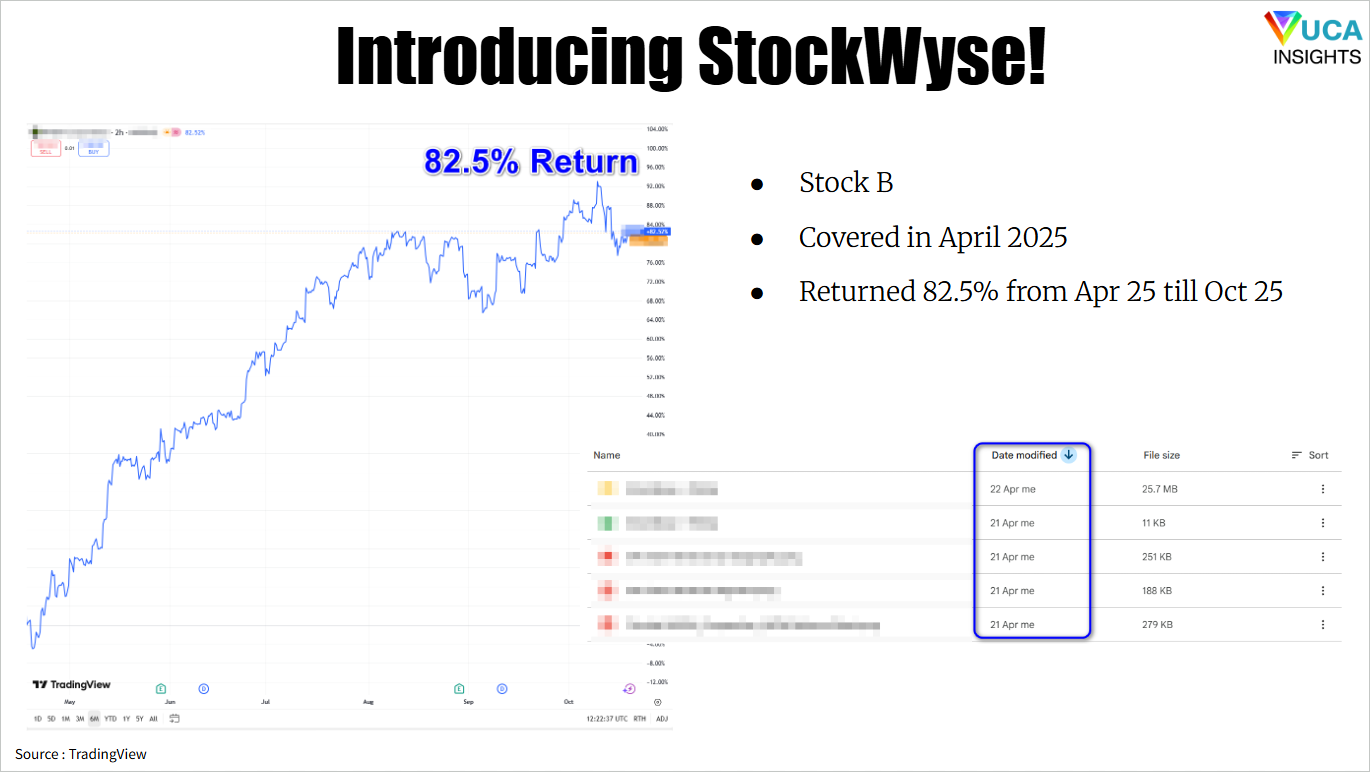

Most programs only tell you the best performers, I'll show you the worst and the middle performers, because I don't need even the best performer to show you the "quality" of StockWyse

Busy investors who want to manage their portfolio but don’t have time for research as well as wanting a credible source of research where they will be investing alongside the researcher (skin in the game).

One full year. And you can choose to renew at the end of your membership, at the same fee you paid, no hike, no inflation.

The objective of StockWyse is to find companies that are among the best in the world at what they do, regardless of geography. Therefore the stock coverage will mainly be global. However, because of our approach to investing, we don’t define stocks by geographical location, but rather, by their position in the value chain. For example, it could be one of the largest suppliers of aircraft engine parts in the world which normally would put them in the Americas or Europe but its listed is in Malaysia. Or the largest aviation IT company in the world not listed on the US stock exchange.

You will get 2 new deep dive webinars a month, a total of 24 webinars every year you are subscribed. Moreover, we have already covered 30+ stocks and you will get those extra instantly when you join today.

This subscription is not suitable for the complete beginner starting from zero. To get the best value out of this subscription, you need to at least have a brokerage account set up, some basic accounting knowledge and at least RM20k to RM50k ready to invest.

No, this subscription is not meant to give buy or sell calls. Instead, it is meant to provide you with all the information you need to make an informed decision yourself on whether to buy or sell.

We have a 30-day refund policy. Should we only receive your cancellation or refund request after 30 days from your initial sign-up date, we can’t offer you a refund or exchange. This refund will exclude SST and other payment provider charges. You will receive the refund within 30-45 days upon request.

If you have more questions in general, e-mail us at [email protected] or [email protected].

With the guidance of a value investor with 16 years of investing experience, comprehensive reports and a private community, you are set for success on day one. Join today and find invest-worthy companies.

“"John is genuine, adds value and is willing to go the extra mile to help people like me understand the industry better. Also, he is truly honest, passionate, committed, and diligent, and he possesses attention to detail in his line of work. He can provide sound advice on financial and other personal matters. There are not many people like him who made a successful career change and remain relevant in this financial industry."”

“When John first told me that he was going to have a new collaboration with KC Lau on a stock research program, I was intrigued. I was part of John and KC Lau’s earlier courses. Some of the most valuable insights I got from StockWyse are in industries that I’m not familiar with or would take too much time to explore deeply. As an ex-engineer myself, I’ve always appreciated and admired John’s in-depth research and analysis, not just on stocks but also on the broader systemic view of industries and value chains. I like that the introduction of stocks happens when they are fairly priced or undervalued. I also appreciate the online StockWyse community but wish it were a bit more vibrant, so we could better leverage the collective wisdom of the group. StockWyse is not for someone who does not appreciate high-quality, deep-dive research and analysis and is just seeking simplistic stock tips. For someone who has the means and interest to invest in the global market (beyond Malaysia) and wants solid, well-guided analysis in a noisy, information-overloaded market space, I would say give StockWyse a go.”

“Stockwyse has been an incredible platform for anyone looking to dive deeper into leading edge businesses globally. It not only provides a comprehensive understanding of business but also enhances and building your own conviction in holding a stock. Definitely a go to place for those who want to build a stronger conviction on the stock you hold and understand a business in more depth”

“I am so glad that I have joined StockWyse to learn more about stock investing with a better-guided approach. The lessons and experiences obtained are invaluable for anyone who wishes to learn how to do stock pickings for counters that are undervalued with good potential for appreciation in the long run. It serves as a good learning point for value investing and provides the tools to adopt a more mature and sensible approach to stock investing. Albeit with some background in financial knowledge, I am totally clueless about the stock market and dared not dabble in it. But with the sound learning platform of Stockwyse, this has helped me to gain confidence in nibbling with some good stock counters for the long hold regardless of their daily share price volatility as the recognition of these counters is in their fundamentals and the prospective long-term gains. Being naïve and not knowing where or how to start, unknowingly I plunged into John Huo’s StockWyse which is actually an advanced level for the mature and seasoned investors, but it turned out to be very interesting and educational for novices like me. John’s investment theses on selected stocks are big eye-openers for both the seasoned players and the amateurish. On top of this is the privilege to be able to be in the private Stockwyse Facebook group and Telegram StockWyse chat group which also helped me to learn and interact with seasoned players as well. With the knowledge and tips learnt from StockWyse, I then later signed up for another stock investing course [called Value Masters] which is an intermediate-level challenge, and then later I signed up for [Dividend Vault] a beginner’s level stock investment course. So I learnt things from the reverse – Advanced Level followed by Intermediate Level and then Beginner’s Level. So by the time I entered the Beginners' Level, learning became a breeze, and I could almost close one eye and learn from it. Learning from the reverse has actually helped me gain more confidence to invest in the stock market. John Huo is really passionate about what he does, and he does it well which is sound and solid. His exuberant excitement of sharing his investment thesis in each session says it all.”

“I have subscribed to John’s stock research services for almost 1 year and the value that I have gotten out of it has far surpassed and paid for the subscription fees for subsequent years. I have benefited from John’s deep dives to complement my own research and this has enabled me to double down on a cybersecurity provider and an active wear provider when both their share prices were beaten down. I often find it a challenge to understand the semi-conductor and biotechnology industries/businesses, and their ecosystem but John has the ability to present them in a manner that my limited cognitive bandwith is able to process and understand. Finally, he delivers each session with so much passion, energy and enthusiasm.”

“The research John did on every company really save me a lot of time on assessing a company in detail or finding a good company to invest.”

See Liung

Teck Siew

Wong Fok Gee

Reena Hiew

SB Lim

Tuck Lee Goon

R.Bushan,

Financial Services Professional

Rui Fong

Wong Wei Tung